SIERRA GROWTH CORP.

(Formerly Grenville Gold Corp.)

Condensed Consolidated Interim Financial Statements

Three and Nine Months Ended September 30, 2020 and 2019

(Unaudited - Expressed in Canadian Dollars)

NOTICE TO READER

Under National Instrument 51-102, Part 4, subsection 4.3(3)(a), if an auditor has not performed a review of the interim financial statements, they must be accompanied by a notice indicating that the interim financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim consolidated financial statements of the Company have been prepared by and are the responsibility of the Company’s management. The unaudited condensed interim consolidated financial statements have been prepared using accounting policies in compliance with International Financial Reporting Standards for the preparation of the condensed interim financial statements and are in accordance with IAS 34 – Interim Financial Reporting.

The Company’s independent auditor has not performed a review of these unaudited condensed interim consolidated financial statements in accordance with standards established by the Canadian Chartered Professional Accountants for a review of interim financial statements by an entity’s auditor.

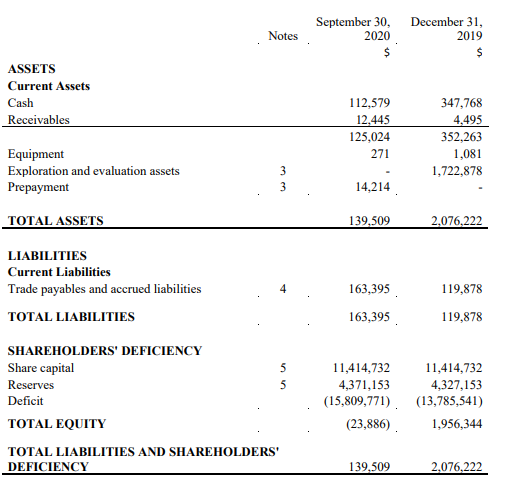

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(Unaudited - Expressed in Canadian dollars)

Nature and continuance of operations 1

Subsequent event 7

The accompanying notes are an integral part of these condensed consolidated interim financial statemen

On Behalf of the Board

"Sonny Janda" "Shaun Dykes"

Sonny Janda, Director Shaun Dykes, Director

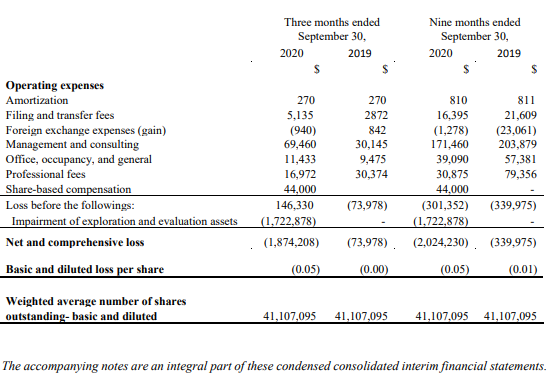

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited - expressed in Canadian dollars)

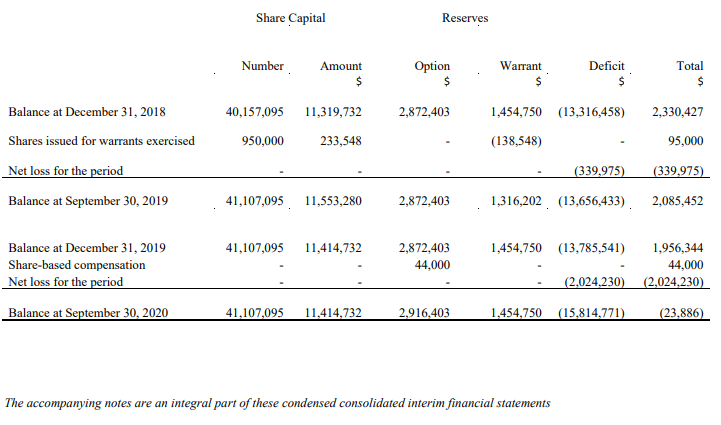

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

(Unaudited - Expressed in Canadian dollars, except share number)

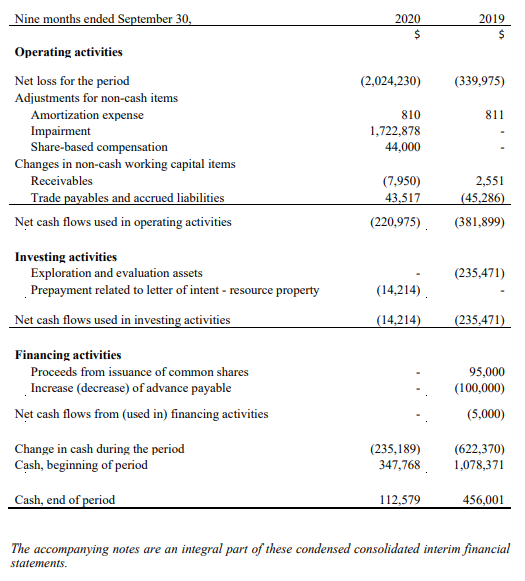

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(Unaudited - Expressed in Canadian dollars)

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019

(Unaudited - Expressed in Canadian dollars)

1. NATURE AND CONTINUANCE OF OPERATIONS

Sierra Growth Corp. (formerly Grenville Gold Corp.) (the “Company”) was incorporated under the laws of the province of Ontario on November 17, 1994. On June 19, 2009, the Company completed a continuance of business from Ontario to British Columbia. On February 15, 2019, the Company changed its name from Grenville Gold Corp. to Sierra Growth Corp. The Company is listed on the Canadian Securities Exchange (“CSE”) under the symbol “GVG” as well as on the Berlin and Frankfurt stock exchanges in Germany under the symbol “F91Q”, and a pink sheet listing (“OTCPP”) in the United States under the symbol “GVLGF”.

The principal business of the Company is the acquisition and development of resource properties with merit.

The head office, principal address and records office of the Company are 4770 – 72nd Street, Delta, British Columbia, Canada, V4K 3N3.

These condensed consolidated interim financial statements have been prepared on the assumption that the Company and its subsidiaries will continue as a going concern, meaning it will continue in operation for the foreseeable future and will be able to realize assets and discharge liabilities in the ordinary course of operations as at September 30, 2020. The Company had not advanced its mining properties to commercial production and has incurred operating losses since inception of its business. The Company’s continuation as a going concern is dependent upon the successful results from its exploration, its ability to attain profitable operations and generate funds from equity, and debt financing to meet its obligations. These factors indicate the existence of a material uncertainty that may cast significant doubt about the Company’s ability to continue as a going concern. Management intends to finance operating costs over the next twelve months with private placements and debt financing from related parties. Should the Company be unable to continue as going concern, the net realizable value of its assets may be materially less than the amounts on its consolidated statement of financial position.

The recent outbreak of the coronavirus, also known as “COVID-19,” has spread across the globe and is impacting worldwide economic activity. Conditions surrounding the coronavirus continue to rapidly evolve and government authorities have implemented emergency measures to mitigate the spread of the virus. The outbreak and the related mitigation measures may have an adverse impact on global economic conditions as well as on the Company’s business activities. The extent to which the coronavirus may impact the Company’s business activities will depend on future developments, such as the ultimate geographic spread of the disease, the duration of the outbreak, travel restrictions, business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. The effect that these events will have on the price of Company’s shares, the ability for the Company to raise capital and operate the mining activities is highly uncertain and as such, the Company cannot determine their financial impact at this time.

These condensed consolidated interim financial statements were approved and authorized for issue by the Board of Directors on November 30, 2020

2. BASIS OF PRESENTATION

Statement of Compliance

These condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standards (“IAS”) 34 Interim Financial Reporting and should be read in conjunction with the annual financial statements for the year ended December 31, 2019, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Basis of Measurement

The consolidated financial statements of the Company have been prepared on an accrual basis and are based on historical costs, modified where applicable. The consolidated financial statements are presented in Canadian dollars unless otherwise noted.

Basis of Consolidation

The consolidated financial statements include the accounts of the Company and its controlled entities. Details of controlled entities are as follows:

| Percentage Owned | |||

|

Country of Incorporation |

September 30, 2020 |

December 31, 2019 |

|

| Grenville Silveria Ltd. | Canada | 100% | 100% |

| Grenville Espanola Holdings Ltd. | Canada | 100% | 100% |

|

Minera Grenville S.A.C. (formerly Inversiones Mineras Alexander S.A.C.) |

Peru | 100% | 100% |

| Minera Espanola S.A.C. | Peru | 100% | 100% |

|

Upper Canyon Minerals Peru S.A.C. |

Peru | 100% | 100% |

Inter-company balances and transactions are eliminated on consolidation.

2. BASIS OF PRESENTATION (CONTINUED)

Significant Accounting Policies

The Company has not changed its accounting policies since its prior year ended December 31,

2019 and has applied accounting policies consistently for all periods presented.

3. EXPLORATION AND EVALUATION ASSETS

| Espanola | |

| $ | |

| Balance, December 31, 2018 | 1,496,430 |

| Maintenance of mineral properties | 226,448 |

| Balance, December 31, 2019 | 1,722,878 |

| Impairment | (1,722,878) |

|

Balance, September 30, 2020 |

- |

Espanola Property

The Company owns 100% of the Espanola property which consists of 17 claims in the San Mateo Mining District in the province of Canete, Peru.

The Company is required to pay permit renewal fees for the Espanola Property during the period ended September 30, 2020. Given the difficulties to manage these properties located in remote areas, management has concluded the Company would like to focus in the acquisition and development of resources properties located in North America. As a result, the Company did not renew the permits of this property and recorded an impairment charges of $1,722,878.

Letter of Intent

On June 25, 2020, the Company entered into a non-binding letter of intent with Primus Resources LC (“Primus”), a Nevada based privately held corporation, whereby Sierra will acquire all of Primus’ right, title, interest, and obligations in and to 3 projects, inclusive of 5 properties consistent of, but not limited to, 50 unpatented gold mining claims (the “Properties”), (collectively the “LOI”).

The Company paid a refundable deposit of $14,214 (USD$10,000) in July 2020 to allow the Company to complete a thorough due diligence and evaluation of the Properties in 90 days. Should due diligence be satisfactorily achieved and the Definitive Agreement executed, the LOI further contemplates:

3. EXPLORATION AND EVALUATION ASSETS (CONTINUED)

Letter of Intent (continued)

- - An outright acquisition over a 6-year period, with an aggregate price (all in USD), per project, as follows:

o Betty East Property $500,000; Mildred/B&C Springs Property $500,000; and New Sat/Glitra Property $675,000.

The aggregate price is subject to an agreed upon schedule containing payments in cash and stock of the Company, which will be more specifically set out in the Definitive Agreement.

-

- - Grant to Primus a 2.0% Net Smelter Return (“NSR”), with buydown provisions as follows:

o Betty East for $1,5000,000 for one-half of the NSR;

o The Mildred/B&C Springs and the New Sat/Glitra Properties for one- half (1%) percent of the NSR can be purchased for the price of $2,000,000. Both these packages contain 2 properties each.

There shall be an area of influence which shall consist of the area within 1.5 miles from the current boundary of the Properties. Any new claims or property acquired within the area of influence shall be subject to the 2% NSR provisions, excepting (1) in case where the acquired claims or property carry an existing 3rd party royalty, in which case, Primus shall only be entitled to any percentage of NSR, if any, that would bring the aggregate total NSR to a maximum of 2%; (2) current active claims of Primus or its principles that are not part of the Agreement which may overlap into the area of influence.

The Company is still in the process of the due diligence as of the date of this report.

4. TRADE PAYABLES AND ACCRUED LIABILITIES

September 30, 2020 December 31, 2019

$ $

Accounts payable 116,145 85,378

Accrued liabilities 47,250 34,500

163,395 119,878

5. SHARE CAPITAL

Authorized share capital: An unlimited number of common shares without par value

An unlimited number of preferred shares without par value

There was no share issuance or redemption during the nine months ended September 30, 2020.

Stock Options

The Company has established a stock option plan whereby a maximum of 10% of the issued and outstanding common shares of the Company may be reserved for issuance pursuant to the exercise of options. The term of the stock options granted is fixed by the Board of Directors and is not to exceed five years. The exercise prices of the stock options granted may not be less than the minimum then specified by the rules of the CSE. Vesting periods are determined by the Board.

On July 20, 2020 the Company granted 1 million incentive stock options to directors, officers, and consultants. These options have an exercise price of $0.15 per share, 100% vested at issuance, and will expire on July 20, 2022.

As at September 30, 2020, the Company had 1,000,000 options outstanding and exercisable. These options have a weighted average exercise price of $0.15 per share and weighted average remaining life of 1.78 years.

Stock Option Reserve

The share-based payment reserve records items recognized as stock-based compensation expense and other share-based payments until such time that the stock options are exercised, at which time the corresponding amount is transferred to share capital.

During the period ended September 30, 2020, the Company recorded share-based compensation of $4,4000. The Company used Black Scholes option pricing model and the following assumptions to determine the fair values of the stock options granted and vested during the current period: risk-free interest rate of 0.27% per annum, expected life of 2 years, annualized volatility of the share price of 160%, and dividend rate of 0.00 % .

Warrant Reserve

The warrant reserve records the fair value of warrants issued until such time that they are exercised, at which time the corresponding amount is transferred to share capital.

6. RELATED PARTY TRANSACTIONS

Key management personnel include those persons having authority and responsibility for planning, directing and controlling the activities of the Company as a whole. The Company has determined that key management personnel consist of members of the Company’ s Board of Directors and corporate officers.

During the nine months ended September 30, 2020, the Company was charged consulting fees of $90,000 (2019 - $104,500) and $18,000 (2019 - $10,000) to a company owned by the CEO and a company owned by the CFO respectively. The Company was also charged by a director for his geological consulting services of $13,460(2019-$Nil)

As at September 30, 2020, $38,750 (2019 - $14,500) was included in trade payables and accrued liabilities from amounts owing to related parties.

7. SUBSEQUENT EVENT

In October, 2020, the Company sold its Silveria mining concessions located in Peru, which was fully written off in 2018, to CIEMSA, a private Peruvian based company engaged in mining related activities. The aggregate sale price of USD $1,000,000 is payable over a three (3) year period commencing August 21, 2020. The Company successfully received the first payment of USD $200,000 as scheduled. The Company retains a 1% NSR for three (3) years commencing upon the date of mineral extraction/production.

Sierra will receive cash payments over a 36-month period amounting to USD $1 million. The cash payment schedule is as follows:

- USD $200,000 upon signing of agreement (received in October 2020)

- USD $100,000 after 12 months

- USD $450,000 after 24 months

- USD $250,000 after 36 months.

In addition to the cash payments, Sierra will receive a 1% NSR for three (3) years commencing upon the date of mineral extraction/production.